Summary

- Margins in the trading of Steem-Engine tokens are way too high

- This situation can be corrected by market making activity

- Market making can be a damn good business

“Deadly Margins In The Trading” – Originally, I wanted to give this headline to my last post about Steem-Engine Tokens market. Because they have 30 percent of average margin (spread) between buying and selling prices, and this, yes, is deadly, far too high. It reveals us a very illiquid market which causes a lot of suffering for small and large investors.

Now or never?

If you are not familiar with this: In this case, if you want to sell only tokens worth 50-100 STEEM, you can push the price 10-40 percent down on this market. If you want to buy a token with 50-100 STEEM, you will probably drive up the price by 10-40 percent, approximately.

Or, you can put an offer in the “book”, somewhere between the best selling and buying prices (bid and offer), and wait patiently. Maybe days, or weeks. Maybe the price shifts and moves away during this period, and your trade never realizes at that price.

Staking kills trading

I wrote last time that the broad margins are signs of the following three phenomenons:

- The product is very risky.

- The buyers and sellers are very scarce, volumes are very low.

- There is only one market-maker in some monopolistic position and this player wants to earn a lot.

But I forgot one: The tribes, the developers, many Steem enthusiasts, bloggers are encouraging people to “stake and hold” the Steem-Engine tokens. (“Power up” on Steemit.com.) This drastically reduces the number of sellers, and thereby also the buyers’ interest, the volume. Another reason can be the falling prices.

Profiting on the bid-ask spread

Don’t only criticize, also make good suggestions – I tell myself. I made one yesterday: We should make more market-making activity, put more offers in the “trading books”.

A market maker is a individual market participant or member firm of an exchange that also buys and sells securities for its own account, at prices it displays in its exchange’s trading system, with the primary goal of profiting on the bid-ask spread, which is the amount by which the ask price exceeds the bid price a market asset. (Investopedia.)

Some eloquent numbers

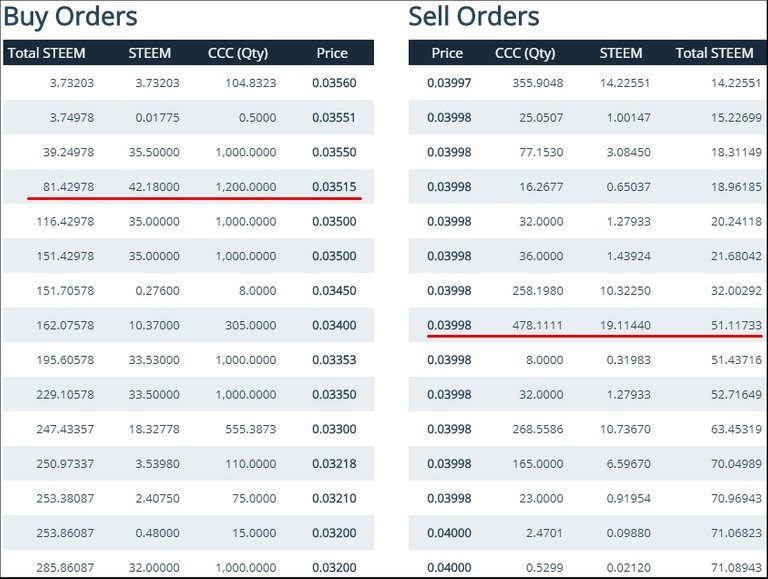

For example? CCC (CreativeCoin token) also has a wide spread, among others. If you want to sell CCC in value of 50 STEEM, you could only do it pushing the price to 0.03515. And if you want to buy 50 CCC, you would complete your order at 0.03998. (Marked with red on the picture.) The difference is 13.7 percent. If you want to buy CCC with 100 STEEM seemingly you couldn’t even do it – we see not enough offers in the “order book” at the moment.

Steem-Engine token market, CCC order book

Market making can be a damn good business. Some stock or bond or commodity exchanges are selling the rights for a lot of money to brokerage firms or individuals who want to be a market maker. Imagine it is an illiquid asset with a one percent margin. If the market maker can reach his goal and sell and buy only once a week, that is 1.01^52=1.6777, that means 67.77 percent annualized yield.

The same market maker can make 180 percent yield (almost triple his capital) in case of a two percent weekly margin. That is great for an investor. I’m also saying to myself, don’t only criticize, make something… Maybe I will try some market-making with some hundreds of STEEM myself.

Selling and buying IBM

Other “fiat” markets are working with totally different, much lower spreads (and lower risks). Read this about the liquid stock market:

If a market maker purchases your shares of IBM from you for $100 each (the ask price), it would offer to sell them to a buyer at, for example, $100.05 (the bid price). The difference between the ask and bid price is only 5 cents, but by trading millions of shares a day, the market maker pockets a significant chunk of change to offset risk.(The Balance)

Lucky of us, Steem-Engine seems to be a market-makers paradise. In other markets, market makers operate with far smaller margins – but mostly with much more frequency than a week. Maybe making trades every hour. Nowadays, most trades of this style are, of course, automatized, robotized.

Business and common good

I’m not a programmer so I can’t robotize this activity. Maybe Steem-Engine developers can offer someday some automated offer types, or somebody will find it rewarding to develop the program needed for it.

Without market makers, it would take considerably longer for buyers and sellers to be matched with one another, reducing liquidity and potentially increasing trading costs as entering or exiting positions would be more difficult. (The Balance)

Market making is good for all. Let’s do it.

Update, important tools:

The author, @cadawg announced new Steem-Engine tools here - related to this post and problems. See the Market Viewer and the Market Calculator on the page.

Series Steem-Engine tokens reports

4. A Costly Hobby For Rich People?

3. Which Was The Most Traded Coin?

2. Which Token Fell 80 Percent In A Single Day?

1. Do You Still Believe In Your Tokens?

(Photo: Pixabay.com, with an effect)